Decree to Make Business Reorganizations More Transparent Announced by Tax Office

| Decree to Make Business Reorganizations More Transparent Announced by Tax Office The General Office of Internal Taxes (DGII in Spanish) stressed the importance of Decree 408-10 pronounced by the Executive Office which will make public the manner in which the Treasury Department will interpret and apply the reorganizational processes carried out by companies who seek to integrate their assets and adapt them to the most utilized contractual judicial forms in modern times. Internal Tax office officials explained that the measures contained in Decree 408-10 will not generate any additional charge to the societies undergoing reorganization as they are consortium or interests groups already conforming to these norms… With the application of this decree, made public on Monday at a national press conference, the Treasury Administration will unify the criteria and will standardize regulations over operations concerning the concentration of businesses as found in the Dominican Tax Code as well as Law No. 479-08 which presides over Commercial Societies and Individual Limited Liability Companies, with the goal of establishing a coherent and uniform fiscal regiment in order to meet the international better practice standards.

| |

Related News

-

(Versión en español) La Independencia Nacional: 181 años después

-

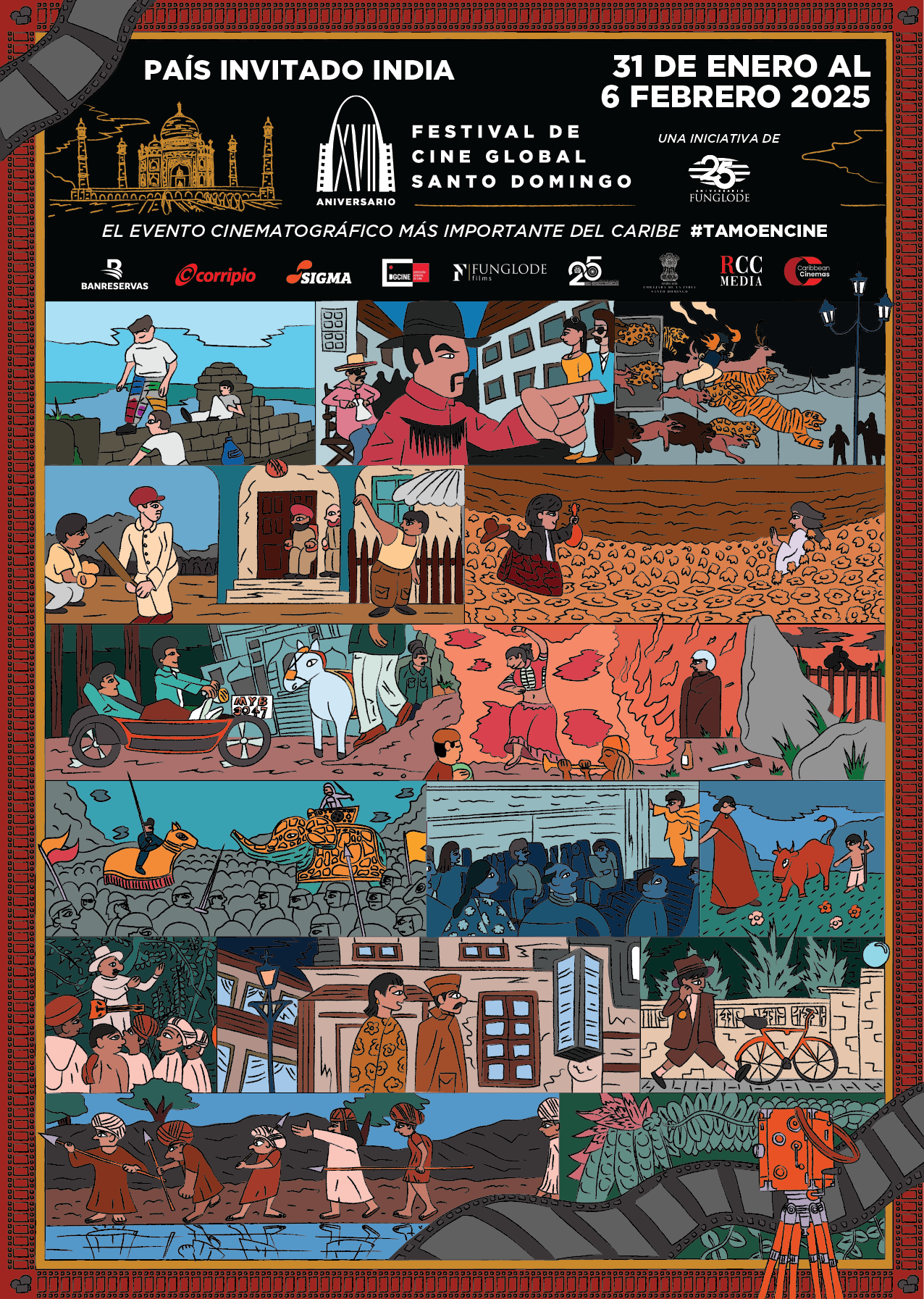

(Versión en español) Vuelve el taller más esperado por los talentos del cine: “Del Casting al Set del Set a la Gran Pantalla”

-

(Versión en español) MINC realiza el evento "Enamórate del Arte y la Cultura" en Los Alcarrizos

-

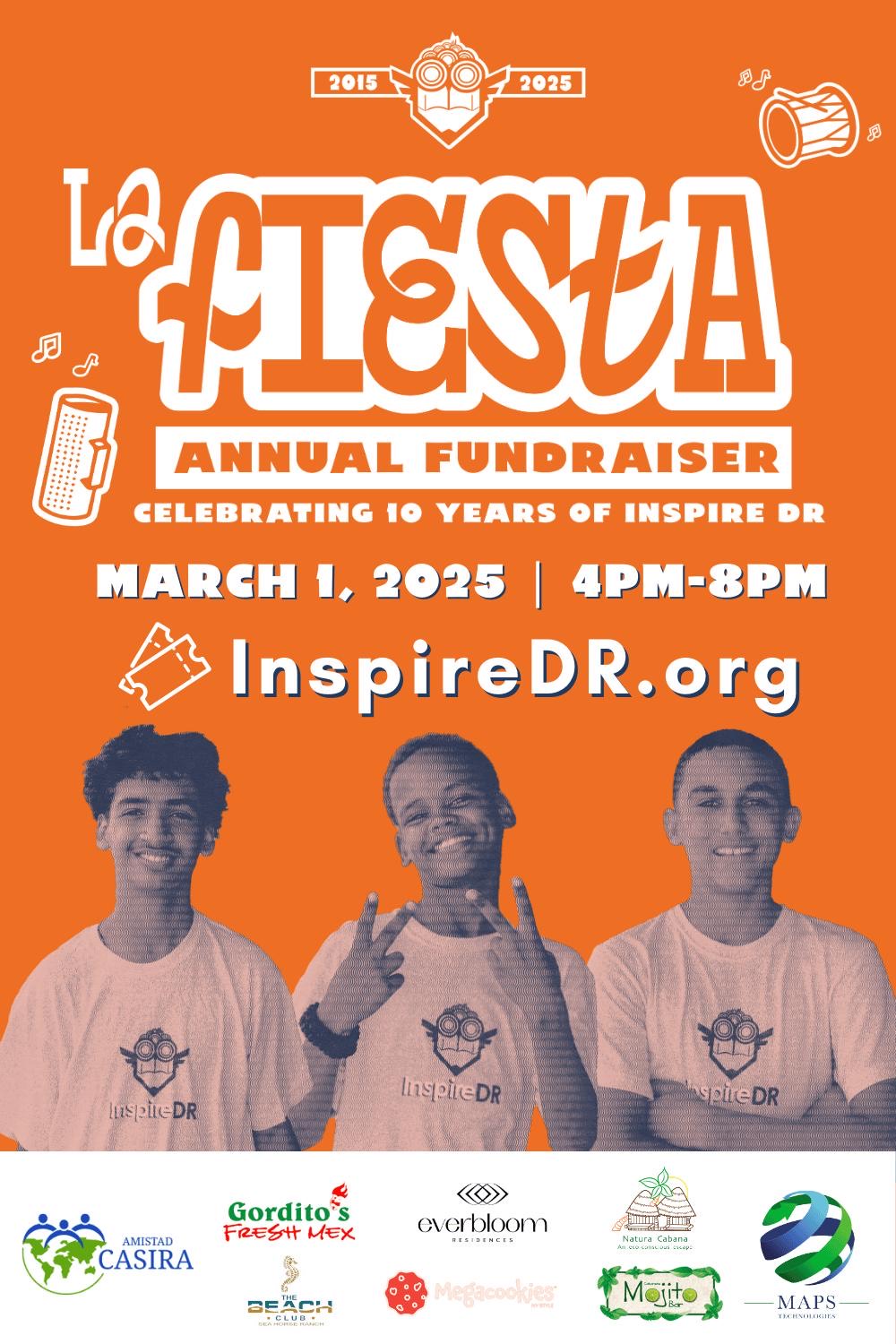

(Versión en español) InspireDR celebra una década de impacto con “La Fiesta 10” en Cabarete

-

Actividad #1

Dónde:: Complejo Acuático Del Centro Olímpico Juan Pablo Duarte.

Días: 28 y 29 de noviembre 2016.

Precios: RD$1,1000.00 VIP, RD$600.00 gradas.