Presenting the new virtual office of the Internal Revenue

| Presenting the new virtual office of the Internal Revenue Speaking before dozens of Dominican business leaders, the Director General of the Internal Revenue, Juan Hernandez, showed the levels of modernity that the institution he leads has achieved, outlining the historical process experienced by the DGII, which started as an informal institution in 1996, and which in 2011 is a thoroughly modern and transparent organization with remarkable technological development. He spoke at the launching of the new phase of the Virtual Office (VOF) of the Internal Revenue, in a ceremony at the institution’s headquarters, which was attended by entrepreneurs from across the country, media executives, State government officials, and the DGII officers, among others. He spoke at the launching of the new phase of the Virtual Office (VOF) of the Internal Revenue, in a ceremony at the institution’s headquarters, which was attended by entrepreneurs from across the country, media executives, State government officials, and the DGII officers, among others. Hernandez described the DGII’s process of technological development to facilitate compliance, enhance transparency, modernize and streamline the tax processes, which are the elements that sustain the positive perception that taxpayers have about the institution. He stressed that in the past five years the Internal Revenue rose from zero percent in Internet transactions and no payments through the banking network, to 85% of the tax returns being sent through the Internet and more than 70% of DGII’s collection is received through the baking network. “Very few still remember that in 1996 (15 years ago) there were some 60 computers at the Income Tax office that were used primarily as typewriters to transcribe reports and for some data processing, and at the office of the Internal Revenue only the issuance of license plates was made using computers. Let alone how to pay, which until 1997 was done mostly utilizing mechanical typewriters,” Hernandez said. In 1996, with only 5,201 employees to raise 11,255 million, the internal tax administration was noted for operating in a simple and traditional way. In the year 2000, once the General Directorates of the Income Tax and the Internal Revenue were unified, the process of technology use gives a quantum leap, focusing on the automation of the most basic tasks for Tax Administration purposes. The Director of the Internal Revenue stressed that the DGII is one of the institutions that handles the largest number of transactions in the country, such as tax returns, payments, information returns, etc., surpassing the 12.5 million electronic transactions originated by the taxpayers on a yearly basis; these transactions are handled with respect for confidentiality and the duty to preserve secrecy. “Taxpayers can be assured that we at the DGII are absolutely committed to safeguarding their information, which is only to be used for purposes of tax administration,” he said. In 2005, the DGII began a rapid rise in Internet use to improve services, reduce compliance costs and offer appropriate information to taxpayers. During that same year, Hernandez said, the first version of the Virtual Office was launched and the system for payment of taxes that now operates at virtually all banks was implemented. “These two events, the implementation of the Virtual Office and paying through banks, mark a ‘before and after’ in Tax Administration,” said the officer. In 2010 the Internal Revenue operates with 2,542 employees, the same number it had in 2004, despite having created major departments such as those for: Tax Receipts, Credit and Compensation, Transfer Pricing, Electronic Security and Tax Printers. They have opened two Control Centers, and an office of Large Taxpayers in Santiago, among others. In the history of the DGII’s modernization process, Hernandez highlighted the issuance of General Standard 03-2011 on the use of electronic means in the Tax Administration, claiming that it set a precedent in the country on the use of the digital signature, and substantially sped-up the logistics of the notification process that is so necessary for maintaining the coverage and the efficiency achieved in the control and supervision activities carried out by the institution. “This measure continues to show our dedication to making the rules of the game transparent in all areas and to ensuring respect for taxpayer’s rights,” Hernandez said. • Good public image The Director General of the Internal Revenue highlighted the good public image that the DGII enjoys among the taxpayers, an element the institution pays close attention to when working on its short, medium and long term plans. “For years the DGII hired outside firms to conduct the same image survey that allows monitoring of the taxpayers’ perceptions of the DGII. From 2007 to present, on average, the findings revealed that: 91% trust this institution; 86% of taxpayers have a positive image of the DGII; 79% considers it efficient; 83.6% understands that the DGII works correctly; 86.8% perceives it as transparent; 82.1% considers it to be organized; and 92% believes it is modern,” explained Hernandez. The official also congratulated the entire work team involved in the technology area led by the Assistant Director General Germania Montas Yapur for having achieved the goals of making the DGII a landmark in the country and in the region in the use of technology to service the organization. | |

Related News

-

(Versión en español) MINC realiza el evento "Enamórate del Arte y la Cultura" en Los Alcarrizos

-

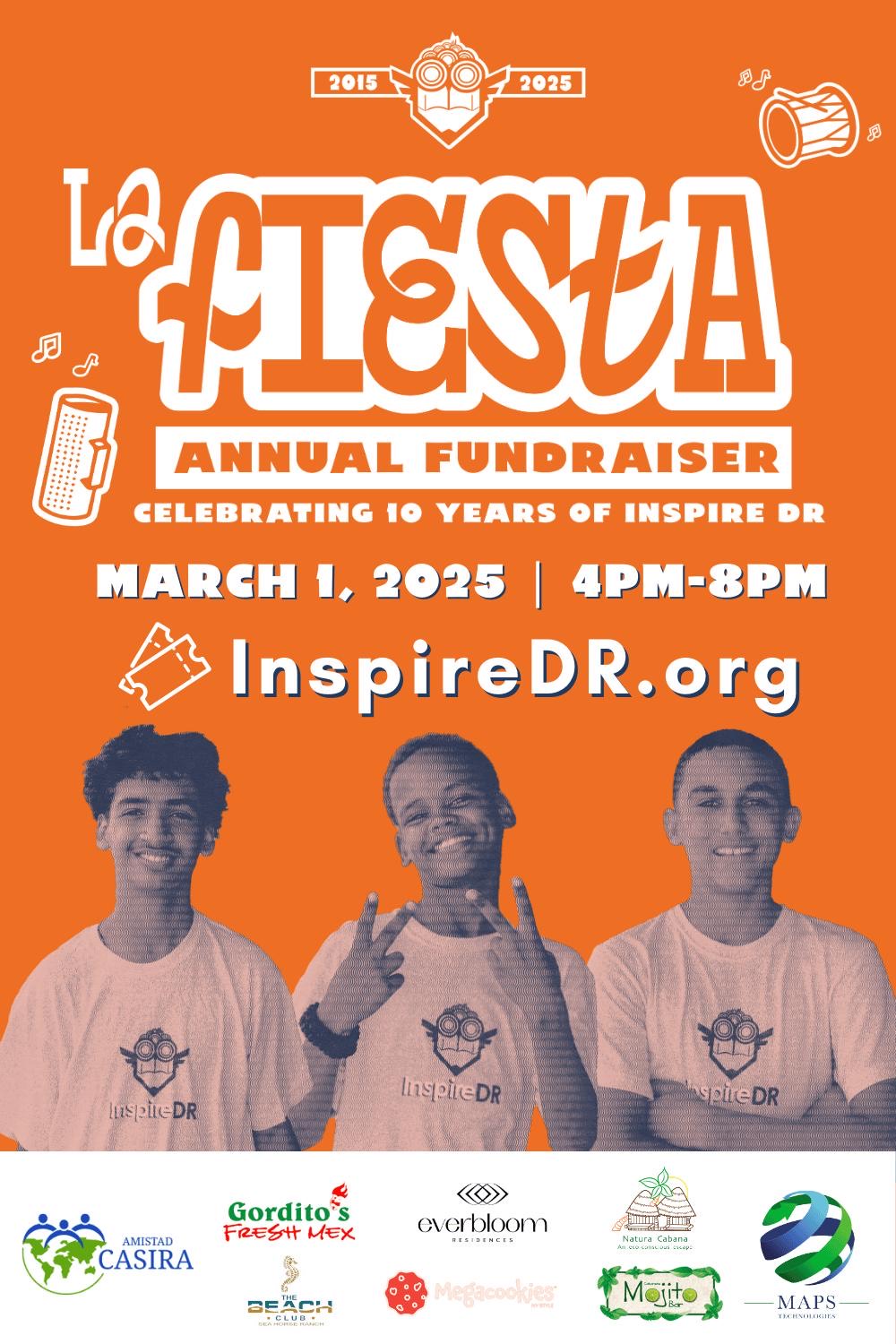

(Versión en español) InspireDR celebra una década de impacto con “La Fiesta 10” en Cabarete

-

(Versión en español) Organización “Juventud Hablemos” de la Universidad de Columbia y la GFDD copatrocinan a casa llena evento sobre “La evolución de la democracia en la República Dominicana”

-

(Versión en español) Realizan premiere del documental “El Padrino II: 50 años y su filmación en República Dominicana”

-

Actividad #1

Dónde:: Complejo Acuático Del Centro Olímpico Juan Pablo Duarte.

Días: 28 y 29 de noviembre 2016.

Precios: RD$1,1000.00 VIP, RD$600.00 gradas.