Government Refunds $190 Billion Dominican Pesos In Education Expense Deductions

| Government Refunds $190 Billion Dominican Pesos In Education Expense Deductions The Internal Revenue Office (DGII in Spanish) reported that this year, the second since Law 179-09 covering Tax Deductions for Educational Expenses for Individuals went into effect, the number of beneficiaries reporting education expenses for themselves or their dependents increased 85% amounting to $190.1 billion pesos in tax returns or compensation. In 2010, according to individual tax declarations, known as ISR, and fiscal educational expenses, the amount spent on education was more than 1.5 billion Dominican pesos in education centers. In 2010, according to individual tax declarations, known as ISR, and fiscal educational expenses, the amount spent on education was more than 1.5 billion Dominican pesos in education centers. Some 11,581 taxpayers benefitted from Law 179-09. Of these, 10,726 declared their taxes through their salaried jobs and 855 as individuals. In observing the number of students for whom education costs are being reported, it is clear that the amount is practically the same in 2010 as it was in 2009. Educational spending was reported for 20,059 students corresponding to the same number of taxpayers seeking tax credits for themselves and/or their dependants or direct relatives who received some type of education in this period. This reflects an increase of 94.4% as compared to last year. GROWTH IN EDUCATION INVESTMENT REPORTED The amount of investment in education reported by the total number of persons declaring taxes rose to RD$ 1,542 billion in 2010, showing an increase of RD $649 billion compared to 2009 and representing a 72.7% growth. Of this amount, RD $1,365 billion was approved for salaried workers and liberal professionals within the requirements of the 2010 law. An education investment classification according to the educational level shows the first level is the highest amount with a 39.4% total investment in 2009 and 38.6% in 2010. TOP 10 DE COMPANIES WHOSE EMPLOYEES REPORTED EDUCATIONAL SPENDING COSTS Educational spending by employees of CODETEL was higher as compared with other companies in 2010 as well as in 2009. The ten companies whose employees reported the highest spending for education are the following: Education spending in 2010 was reported in 953 education centers; this was an increase of 26.4% from last year. The highest number of education centers accounted for 32.5% of all educational spending reported.

The Educational Centers are: This Law establishes that salaried workers, liberal professionals and independent workers filing individual tax declarations (ISR), can regard any expenses incurred for personal educational costs and/or educational costs of one’s dependents who are not employed (this is in addition to the exemption established under Article 296 of the Tax Code) to be deducted from your income tax declaration. The Internal Revenue Office (DGII), through Norm 06-09, establishes that salaried workers eligible to benefit from Law 179-09, must provide documents proving that they have incurred these costs. These documents must be completed and presented to the Virtual Office of the DGII. To accept or complete the declaration proposed by the DGII, they must provide information on all expenditures made by no later than the last working day of the month of February (individuals or liberal professionals must include all proof of educational spending receipts and forms in their annual tax declaration). Download Law No. 179-09 on the Deduction of Education Costs > | |

Related News

-

(Versión en español) MINC realiza el evento "Enamórate del Arte y la Cultura" en Los Alcarrizos

-

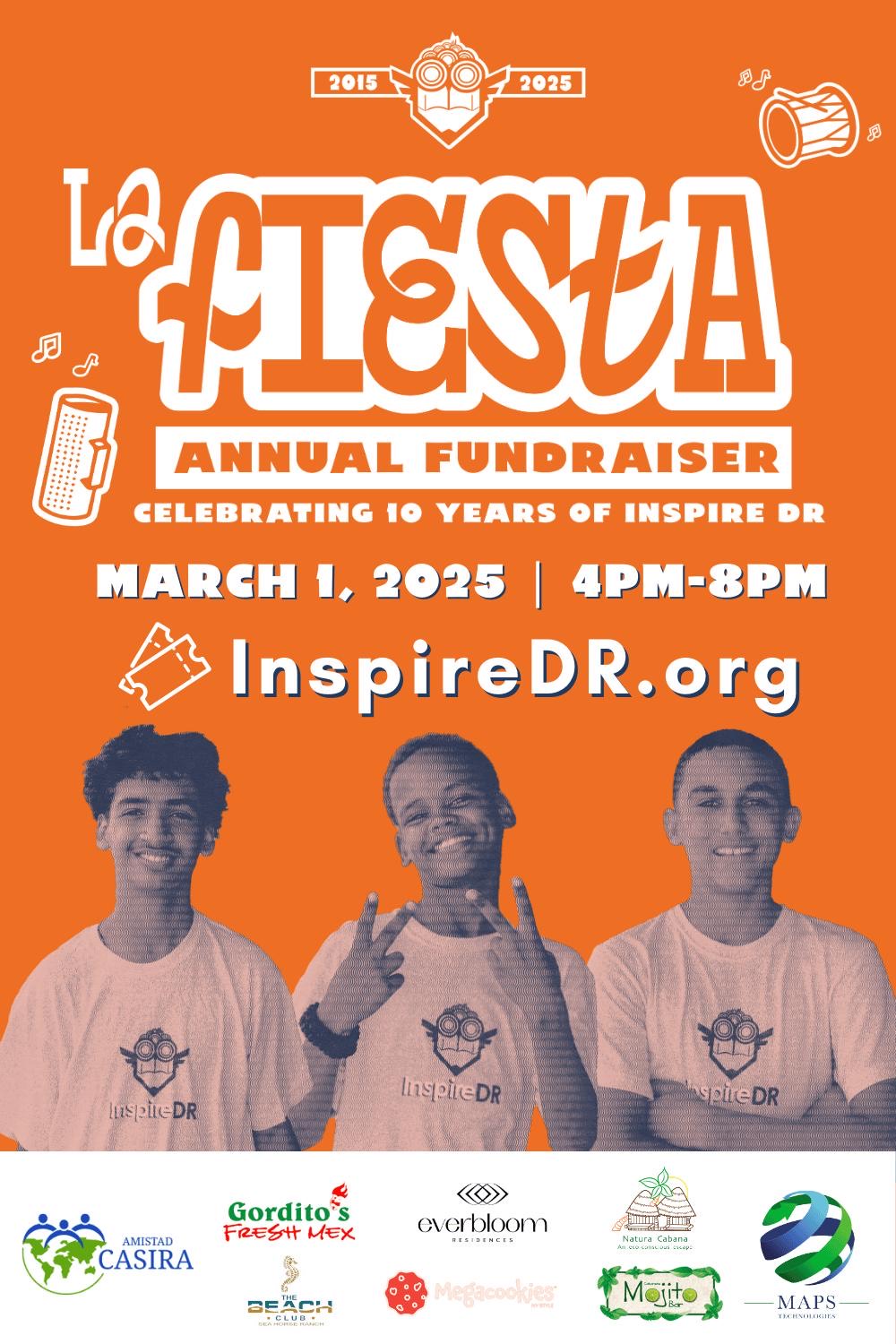

(Versión en español) InspireDR celebra una década de impacto con “La Fiesta 10” en Cabarete

-

(Versión en español) Organización “Juventud Hablemos” de la Universidad de Columbia y la GFDD copatrocinan a casa llena evento sobre “La evolución de la democracia en la República Dominicana”

-

(Versión en español) Realizan premiere del documental “El Padrino II: 50 años y su filmación en República Dominicana”

-

Actividad #1

Dónde:: Complejo Acuático Del Centro Olímpico Juan Pablo Duarte.

Días: 28 y 29 de noviembre 2016.

Precios: RD$1,1000.00 VIP, RD$600.00 gradas.