Latin American Countries Want To AcquireThe Technological Innovations That The Internal Revenue Service Has

| Latin American Countries Want To AcquireThe Technological Innovations That The Internal Revenue Service Has The Director General of the Internal Revenue (DGII for its acronym in Spanish) hosted delegations from Curacao, El Salvador, Ecuador, and Paraguay, who are interested in implementing in their own countriestechnology programs that have been developedin the Dominican Republic. The Dominican experience with the Virtual Office Technology, the Shared Information System, Fiscal Printers, and Tax Receipts projects is of great interest to the Tax Administrations of Curacao, El Salvador, Ecuador, and Paraguay. The Director General of the Internal Revenue service, Juan Hernández, received a new delegationthis week, this time from El Salvador, to coordinate cooperation initiatives to replicate the Dominican experience, in terms of technology in Tax Administration, in several sister nations. The Salvadoran delegation included:Lic. Juan Neftalí Murillo Ruiz, Director General of the Treasury;Lic. Ramón A. Pérez, Assistant Director of the Internal Revenue Office;Eng. Carmen María Hernández de Mancía, Head of the Tax Assistance Division;Eng. Eduardo Alexander Rivera López, National Assistant Director of the Tax Administration; and Lic, Lilena Guadalupe Martínez de Soto, Coordinator of Innovation and Portal Management. This delegation held meetings over the course of a week with the different groups that developed the technology projects that have had a very positive impact in the monitoring and improvement of tax collections. As it turns out, the DGII has become an international point of reference in regard to the proper use of technologies to achieve a more efficient method of tax collection. Proof of this is that recently several Latin American delegations from the tax administrations have visited the DGII with the purpose of studying the successful technology projects that havebeen developed here, so that they can implement them in their own countries. The Dominican experience with the Virtual Office Technology, the Shared Information System, Fiscal Printers, and Tax Receipts projects is of great interest to the Tax Administrations of Curacao, El Salvador, Ecuador, and Paraguay. The Assistant Director General of Operations and Technology, Germania MontásYapur, has hosted the Technical Commissionssent by those countries. She also heads the evaluation committees that address the requests for collaboration that have beenmade byher counterparts, so that these technological projects can be implemented in their own tax administrations. “We have worked on technical cooperation initiatives with many countries. The truth is that our Virtual Office’s Shared Information System is good enough for people to like it. No other Latin American country, except for Chile, Brazil and Argentina, has it. We are very well positioned when it comes to the use of technologies because of how well all these tools function,” she explained. MontásYapurfurther explained that Curacao’s Technical Commission has already made several visits given that Curacao’s Prime Minister wants his tax administration to use the exact same technology platform that DGII has. “They want to implement our Virtual Office technology for Tax Receipts, Fiscal Printers, payments in banks in real-time, and the Shared Information Systems. When the Prime Minister told us ‘I want in my country the same technology projects that the Dominican Republic has,’ we were surprised. We are now a point of reference in the field of technology, and that makes us feel very proud,” she added. The DGII has also hosted delegations from El Salvador and Paraguay, with the objective of training their staff in the Virtual Office and Shared Information System technologies, so that they can use them in their respective countries. Similarly to Greece, a country that is seeking to implement a system comparable to the one described in Standard 08-04, which establishes transparency of the ITBIS (ImpuestosobreTransferencias de BienesIndustrializados y Servicios) on credit and debit card purchases and the withholding of a percentage of the fiscally transparent value of the taxes. To this end, the International Monetary Fund has asked for DGII’s help in providing all information on the implementation of the project.

| |

Related News

-

(Versión en español) MINC realiza el evento "Enamórate del Arte y la Cultura" en Los Alcarrizos

-

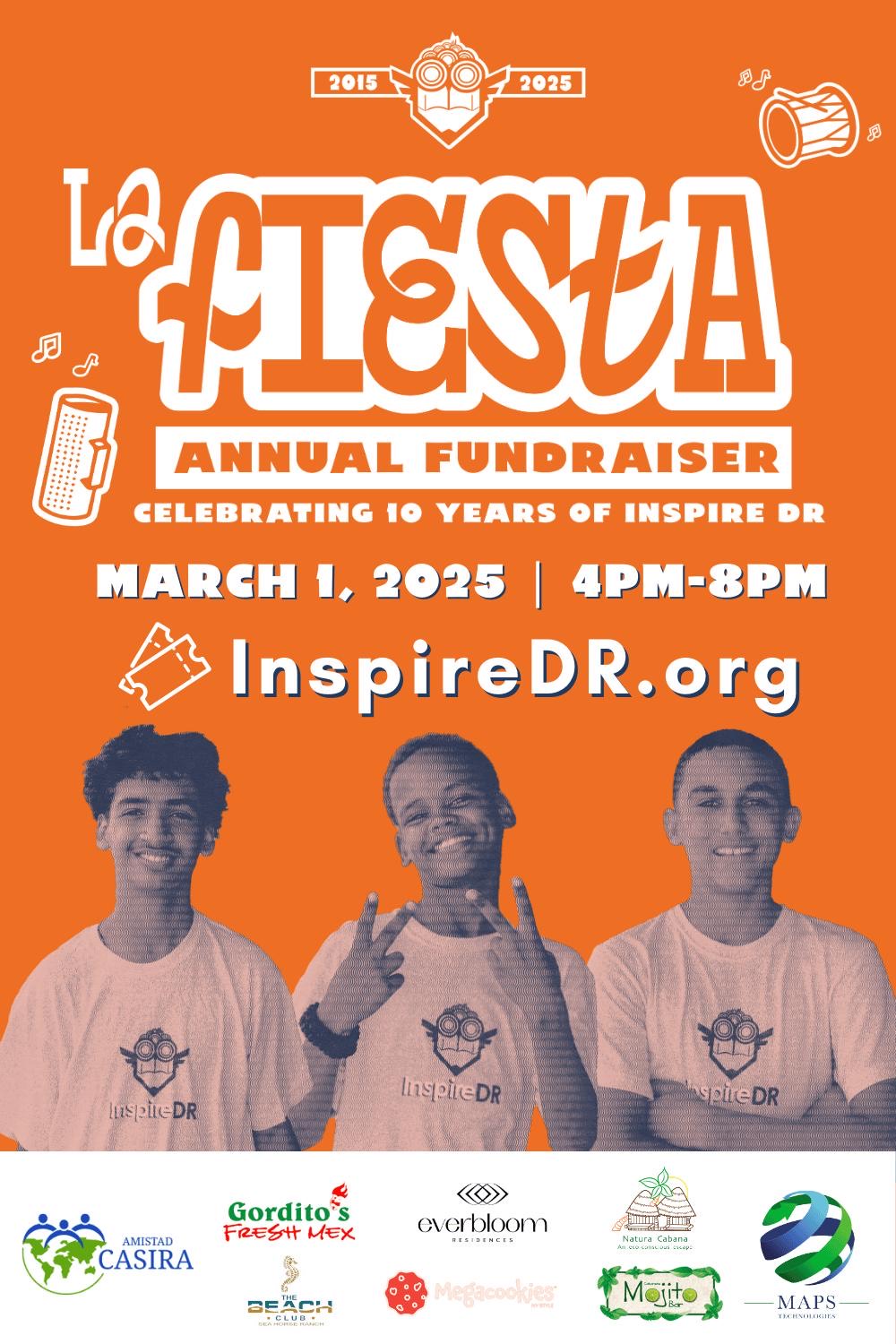

(Versión en español) InspireDR celebra una década de impacto con “La Fiesta 10” en Cabarete

-

(Versión en español) Organización “Juventud Hablemos” de la Universidad de Columbia y la GFDD copatrocinan a casa llena evento sobre “La evolución de la democracia en la República Dominicana”

-

(Versión en español) Realizan premiere del documental “El Padrino II: 50 años y su filmación en República Dominicana”

-

Actividad #1

Dónde:: Complejo Acuático Del Centro Olímpico Juan Pablo Duarte.

Días: 28 y 29 de noviembre 2016.

Precios: RD$1,1000.00 VIP, RD$600.00 gradas.