Tax Office Director Guaroguya Felix Presents 2013 Guidelines for Anti-Tax Evasion Plan

| Tax Office Director Guaroguya Felix Presents 2013 Guidelines for Anti-Tax Evasion Plan The Director General of the Internal Tax Office (DGII in Spanish) explained that there are four major points of action and operation around which the Anti-Tax Evasion plan for 2013 revolves: Oversight, Revenue, Collection and Tax Intelligence. “The purpose of these programs are also meant to cleanup and improve contributors’ records as a way of closing the gap between those who pay their taxes and those who evade them,” said Mr. Felix. Speaking at a conference, “Voluntary Compliance and Controls Concerning Evasion,” the director general told a group at a breakfast meeting organized by ParticipaciónCiudadana (Citizen’s Participation), Guarocuya Felix said the DGII will implement six programs in the coming year to increase the universe of contributors and elevate the perception of risk, incentivizing voluntary compliance with tax obligations. “The purpose of these programs are also meant to cleanup and improve contributors’ records as a way of closing the gap between those who pay their taxes and those who evade them,” said Mr. Felix. At the meeting, held in the Hotel Hilton, the DGII Director enumerated the programs: Interchange of information and collaboration of public entities such as DGAand the National Office of Catastrophe; Identification of registered contributors who do not carry out commercial operations or services; Fiscal intelligence actions; Continuity and implementation of projects of oversight systems like the generalized installation of fiscal printers and the implementation of the electronic invoice; Strengthening of oversight and verification actions and the continuity of actions involving persecution and compliance of contributors. “Many of the actions in this plan are already being applied by the DGII and we intend to improve on them and make them more efficient while implementing adaptations when applicable. Nevertheless, the big challenge will consist in enforcing the new measures that will enable us to combine them with the best anti-evasion practices used by tax administrations in Latin America and OECD countries,” said Felix. Regarding oversight, Guarocuya Felix said theDGIIwill improve the quality of tax auditors, contributor selection methods and the adequate use of cross-checking information. In terms of collection, the DGII intends to strengthen control on omission and default, especially among local administrations. “In the case of collection, the quality of the coercive collection process must be improved while consolidating processes for follow-up. Concerning tax culture, the goal is to improve the tools and technological platform to make it more efficient in controlling income and expenses of taxpayers and to ultimately raise the specter of punishment for tax evasion,” he explained. | |

Related News

-

(Versión en español) MINC realiza el evento "Enamórate del Arte y la Cultura" en Los Alcarrizos

-

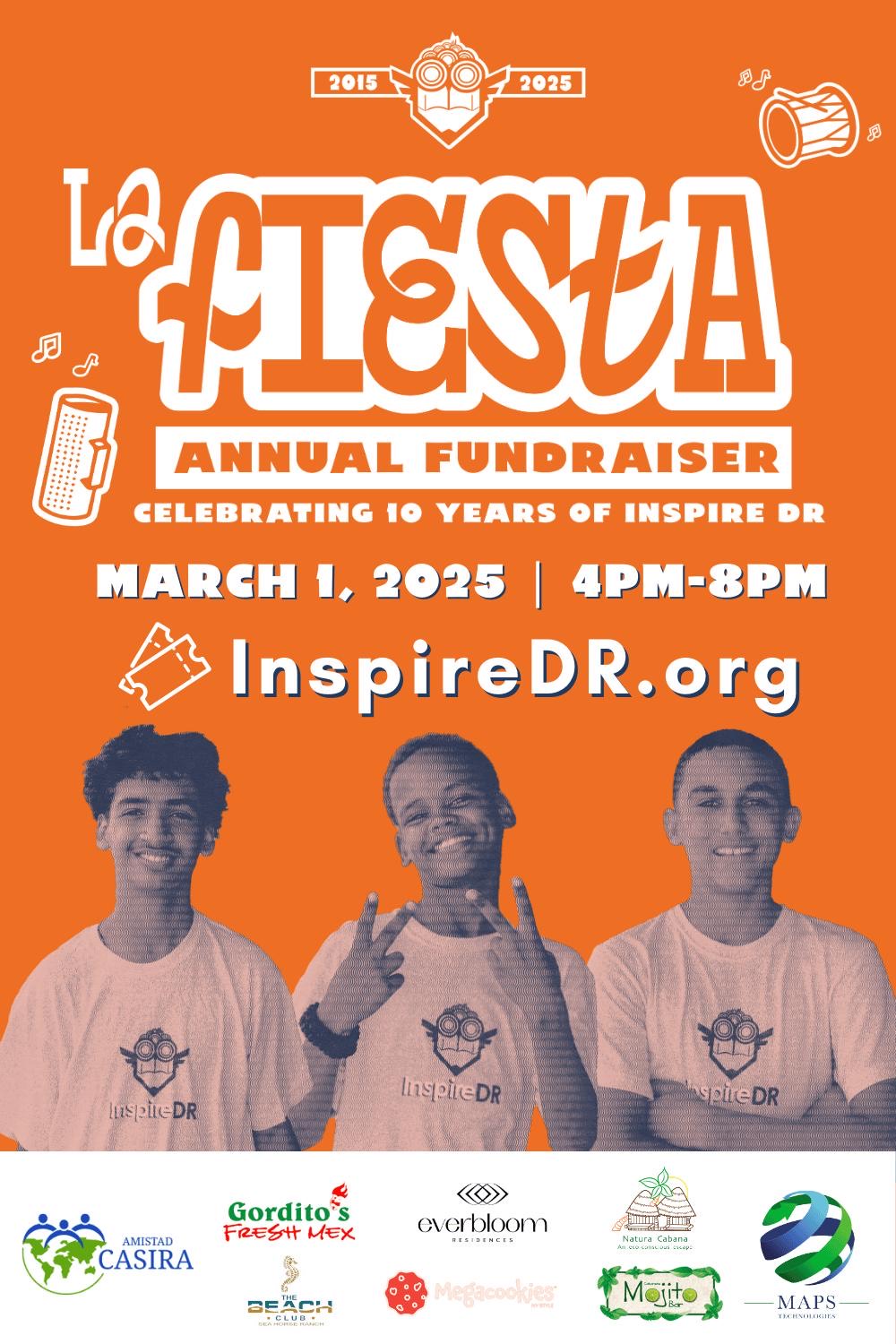

(Versión en español) InspireDR celebra una década de impacto con “La Fiesta 10” en Cabarete

-

(Versión en español) Organización “Juventud Hablemos” de la Universidad de Columbia y la GFDD copatrocinan a casa llena evento sobre “La evolución de la democracia en la República Dominicana”

-

(Versión en español) Realizan premiere del documental “El Padrino II: 50 años y su filmación en República Dominicana”

-

Actividad #1

Dónde:: Complejo Acuático Del Centro Olímpico Juan Pablo Duarte.

Días: 28 y 29 de noviembre 2016.

Precios: RD$1,1000.00 VIP, RD$600.00 gradas.