The Internal Revenue announces that it will easethe conditions to meet eligibility under Tax Amnesty Law 309-12

| The Internal Revenue announces that it will easethe conditions to meet eligibility under Tax Amnesty Law 309-12 Forms are available through www.dgii.gov.do, as well as at the local DGIIoffices, the headquarters of the Taxpayer Assistance Center, and soon also through the Virtual Office. In this regard, the Internal Revenue warns taxpayers that in case of breach of the established payment agreement, the request for amnesty will be dismissed and the payments that have already been made will be regarded as prepayments. Santo Domingo. National District. The Directorate General of the Internal Revenue (DGII for its acronym in Spanish) announced that it will ease the conditions for all taxpayers interested in meeting the conditions for eligibility under the Tax Amnesty Law for Strengthening the State RevenueCapacity, Fiscal Sustainability and Sustainable Development. For this purpose, according to the notice that was published in the national media on Thursday, the government agency has already made available the amnesty application form both at the www.dgii.gov.doInternet portal, as well as at the local DGII offices, and at the headquarters of the Taxpayer Assistance Center. Also, the formal application may soon be submitted online through the Virtual Office https://www.dgii.gov.do/ofv/login.aspx. The tax amnesty has already entered into force and covers Income Taxes (ISR), Taxes on the Transfer of Industrialized Goods and Services (ITBIS); Taxes on Inheritance; Taxes on Real Estate Property (IPI);Taxes on Transfers;Taxes on the Assets Applied to Real Estate Property;and, in addition, taxes on interests, surcharges and penalties relating to the importation of goods. Law 309-12 establishes a period of sixty (60) days to file the intent to avail oneself of the amnesty. The application is to be submitted to the local government that corresponds to the taxpayer, or through the Virtual Office of the Internal Revenue. Once the form is submitted, the Internal Revenuemust respond within fifteen (15) days after its receipt,either to reject it or to accept it. According to the notice that was published, if the application is approved, the DGII will informof the amount that must be paid under the provisions of Article 3 of the Law. After receiving the affirmative decision from the DGII, the taxpayer shall have twenty (20) days to pay in one lump sum, which is exempt of interests and penalties. The taxpayer may also request a payment agreement with an initial payment of forty percent (40%) of the total amount due and two successive monthly installments from the date of the initial payment. In this regard, the Internal Revenue warns taxpayers that in case of breach of the established payment agreement, the request for amnesty will be dismissed and the payments that have already been made will be regarded as prepayments. |

Related News

-

(Versión en español) MINC realiza el evento "Enamórate del Arte y la Cultura" en Los Alcarrizos

-

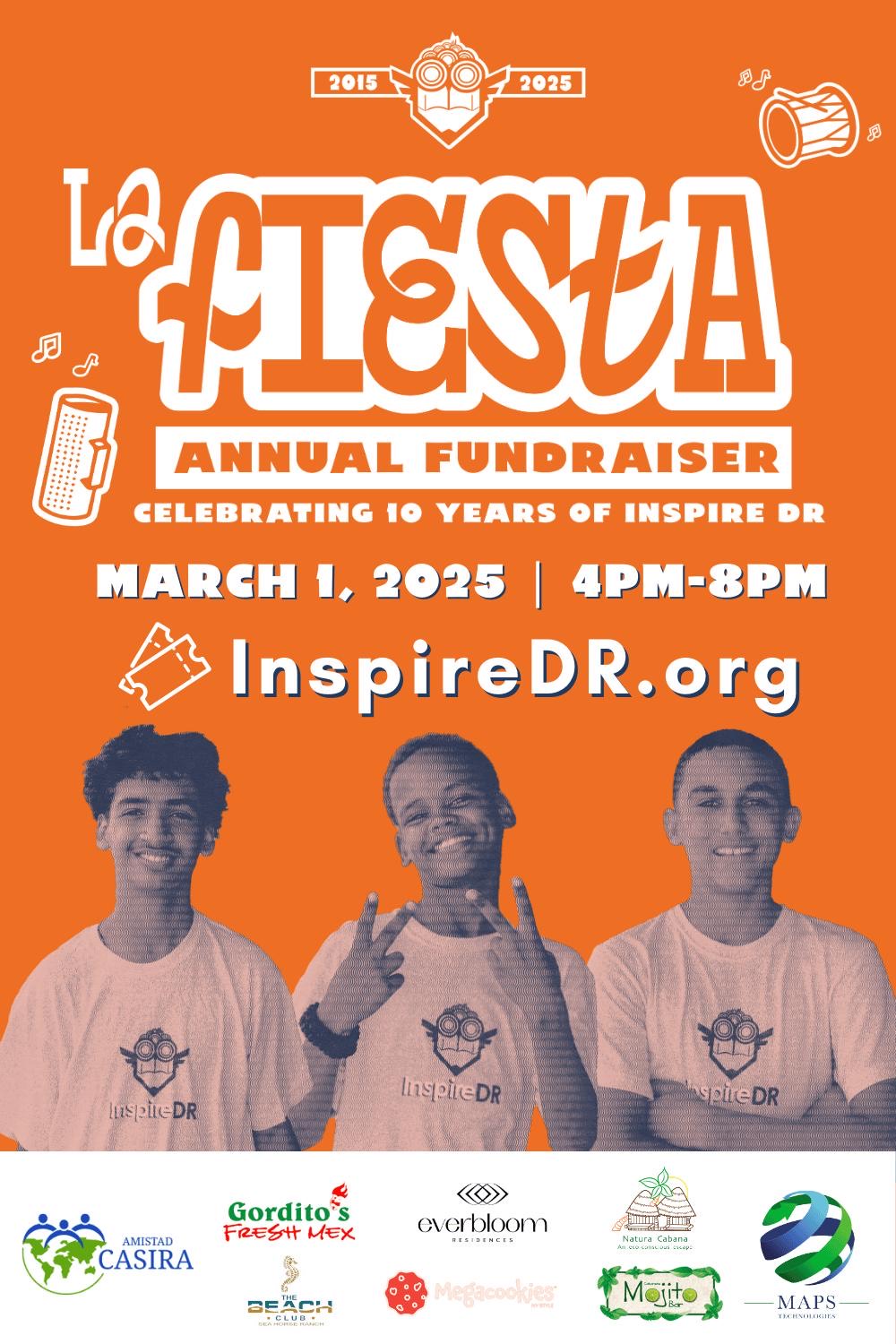

(Versión en español) InspireDR celebra una década de impacto con “La Fiesta 10” en Cabarete

-

(Versión en español) Organización “Juventud Hablemos” de la Universidad de Columbia y la GFDD copatrocinan a casa llena evento sobre “La evolución de la democracia en la República Dominicana”

-

(Versión en español) Realizan premiere del documental “El Padrino II: 50 años y su filmación en República Dominicana”

-

Actividad #1

Dónde:: Complejo Acuático Del Centro Olímpico Juan Pablo Duarte.

Días: 28 y 29 de noviembre 2016.

Precios: RD$1,1000.00 VIP, RD$600.00 gradas.