Internal Revenue Office Maintains Tax Breaks in Place for Agricultural Sector

| Internal Revenue Office Maintains Tax Breaks in Place for Agricultural Sector An explanation of the tax provisions is contained in General Tax Regulation 01-13, published on Monday in the National Press. This deals with measures relating to exemptions for the payment of anticipated amounts of income, asset and withholding tax as well as payments made by the government in this economic sector. The General Office of Internal Revenue (DGII in Spanish) announced the extension of tax breaks for the agricultural sector for the entire fiscal year, 2013. This deals with measures relating to exemptions for the payment of anticipated amounts of income, asset and withholding tax as well as payments made by the government in this economic sector. Through the General Tax Regulation 01-2013, which goes into effect on Monday May 13th, the Internal Revenue reaffirms the interest on the part of the Dominican government to maintain the conditions that enable the development of the agricultural sector to develop and not to have to alter their economic decisions based on fulfilling their tax obligations. This measure is a continuation of the provisions established in General Taxation Norms 01-2008, 02-2009, 03-2010 and 01-2012. The extensions that benefit the agricultural sector went into effect in 2008 to help and support farmers, fishermen and cattle ranchers who suffered great losses and damage caused by tropical storms Olga and Noel. |

Related News

-

(Versión en español) MINC realiza el evento "Enamórate del Arte y la Cultura" en Los Alcarrizos

-

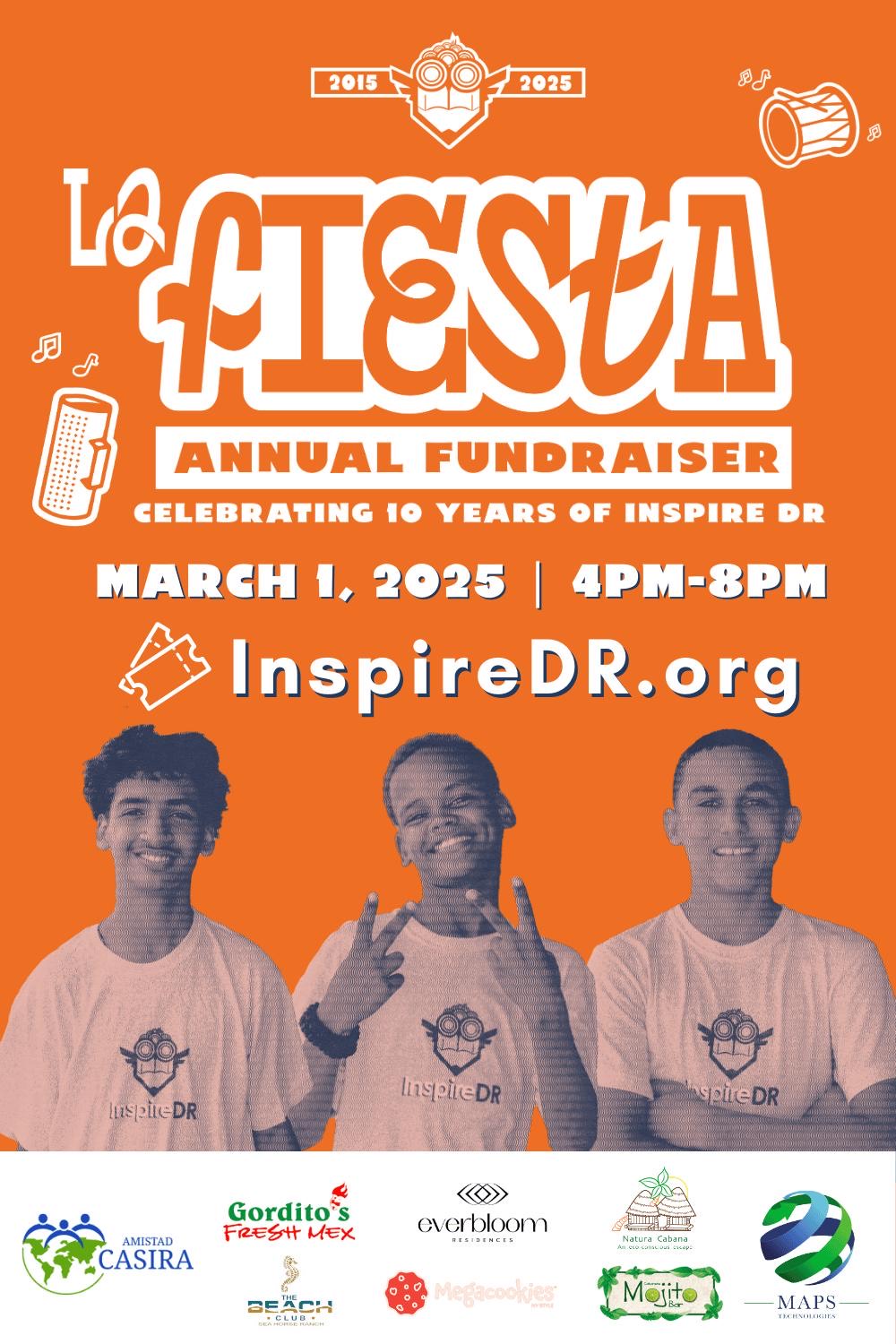

(Versión en español) InspireDR celebra una década de impacto con “La Fiesta 10” en Cabarete

-

(Versión en español) Organización “Juventud Hablemos” de la Universidad de Columbia y la GFDD copatrocinan a casa llena evento sobre “La evolución de la democracia en la República Dominicana”

-

(Versión en español) Realizan premiere del documental “El Padrino II: 50 años y su filmación en República Dominicana”

-

Actividad #1

Dónde:: Complejo Acuático Del Centro Olímpico Juan Pablo Duarte.

Días: 28 y 29 de noviembre 2016.

Precios: RD$1,1000.00 VIP, RD$600.00 gradas.