Internal Revenue

| Internal Revenue Receives $36.4 Million from Barrick Gold as First Payment of Annual Minimum Tax The General Directorate of Internal Taxes (DGII in Spanish) today received a payment from the Barrick Pueblo Viejo Dominicana Corporation of $36,429,046 US dollars for the Minimum Tax Year (IMA) of 2012, a result of the Second Amendment to the Special Agreement on Mineral Rights Leasing reached by the government and the mining company. The payment was made at a meeting in the headquarters of Internal Revenue between the Director General of Inland Revenue, Guarocuya Felix, and Mr. V. Manuel Rocha, President of the Barrick Pueblo Viejo Dominicana Corporation (PVDC in Spanish), accompanied by senior officials of the two institutions to implement measures that guarantee a minimum income to the State based on the gross sales of minerals that the PVDC makes. The payment was made at a meeting in the headquarters of Internal Revenue between the Director General of Inland Revenue, Guarocuya Felix, and Mr. V. Manuel Rocha, President of the Barrick Pueblo Viejo Dominicana Corporation (PVDC in Spanish), accompanied by senior officials of the two institutions to implement measures that guarantee a minimum income to the State based on the gross sales of minerals that the PVDC makes. At the meeting, the two sides also agreed on the dates for the IMA payments in the period January-December 2013 to comply with the provisions of the Amendment, which stipulates that payments be made in three installments in the last quarter of the year and as a payment of this tax based on the affidavit of mining activities in 2012. The IMA is a tax that was introduced in the second amendment to the Special Agreement Mining Lease (CEAM in Spanish), to ensure that the minimum state income is based on the gross sales of the minerals that the PVDC makes. To make the calculation for the 2012 period, Internal Revenue applied a 24.25% rate on gross sales of minerals, as agreed to in Article 8.5 of the amendment adopted by the National Congress. The agreement provides that this payment should be made within fifteen (15) days of notification that the amendment was approved. The PVDC notified the Internal Revenue of its approval by publishing it in the Official Gazette on October 4th. It should be noted that the government announced publicly last September that a final agreement had been reached on the amendment for the lease of the Pueblo Viejo mine to Barrick Gold, highlighting the point about the Annual Minimum Tax (IMA) on gross revenues derived from exports of all metals that the mining company makes. During the meeting at the Internal Revenue (DGII) headquarters, dates were agreed upon for payments that Barrick Gold will advance as a prepayment on the Annual Minimum Tax for 2013.

|

Related News

-

(Versión en español) MINC realiza el evento "Enamórate del Arte y la Cultura" en Los Alcarrizos

-

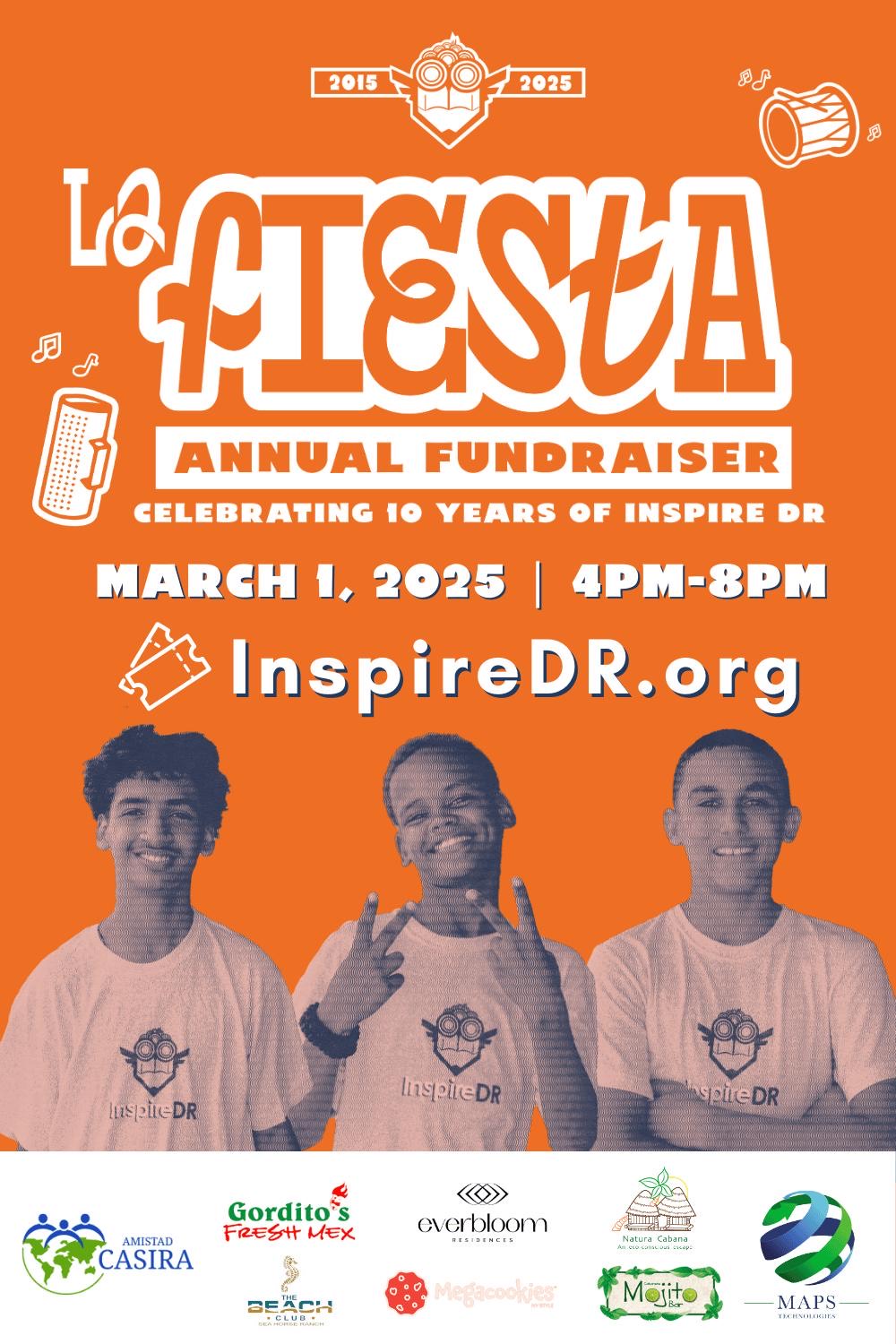

(Versión en español) InspireDR celebra una década de impacto con “La Fiesta 10” en Cabarete

-

(Versión en español) Organización “Juventud Hablemos” de la Universidad de Columbia y la GFDD copatrocinan a casa llena evento sobre “La evolución de la democracia en la República Dominicana”

-

(Versión en español) Realizan premiere del documental “El Padrino II: 50 años y su filmación en República Dominicana”

-

Actividad #1

Dónde:: Complejo Acuático Del Centro Olímpico Juan Pablo Duarte.

Días: 28 y 29 de noviembre 2016.

Precios: RD$1,1000.00 VIP, RD$600.00 gradas.