DGII colections grew by 16.6% during the first quarter of the year, excluding extraordinary income

| DGII colections grew by 16.6% during the first quarter of the year, excluding extraordinary income The Internal Revenue reported that it had collected RD$118,438.3 million, or RD$20,893.1 million more than what it had collected between January and April, 2013 The Directorate General of the Internal Revenue (DGII) reported that it had attained an inter-annual increase in revenues of 16.6% during the first quarter of the year, when compared to the same period last year, excluding extraordinary income. This exceeds the nominal growth projected for the economy, which is 9.2% for 2014, and that this is clear evidence of the efficiency of the tax administration. In the January-April period, the revenue collected by the DGII totaled RD$118,438.3 million, an increase of RD$20,893.1 million, which represents a growth of 21.4% over the same period last year. With respect to the goal, the collection between January and April, 2014, represents a performance of 106% accounting for 81% of the total State revenue. Customs accounted for 16% of the revenue, and the National Treasury collected the remaining 3%. It should be noted that during the period from January to April of this year, RD$10,152 million were collected for non-recurring income from capital gains on the purchase of companies in the telecommunications sector. In turn, RD$621.2 million were collected due to the marginal effect of the tax reform (Law 253-12); RD$339.9 million from the amnesty payments agreements (Law 309-12); RD$873.9 from the Minimum Annual Tax paid by the Pueblo Viejo Dominicana Corporation (Barrick); and, finally, RD$291.7 million from audits to the Hydrocarbon Tax. Likewise, in January-April of 2013, RD$2,500 million in extraordinary income were collected as an advance from the Tax on the Assets of the Financial Intermediary companies; RD$3428.1 million were collected from the Tax Amnesty (Law 309-12), and RD$558.7 million from the audits on Pricing of Transfers. In this regard, for effective comparison of the current quarter versus the prior year quarter, we eliminated any extraordinary revenue collected in the two periods being analyzed, and the resulting collection represents an inter-annual growth of 16.6%. This figure exceeds the nominal growth of the economy measured by the GDP projected by the authorities, and this is clear evidence of the efficiency of the tax administration. The 2014-2018 Macroeconomic Framework of the Ministry of the Economy projects a growth of 9.2% of the nominal GDP for 2014. The report of the Department of Economic Studies of the Internal Revenue indicates that, particularly in April of 2014, the revenue collected by the DGII totaled RD$44,043.9 million, representing an increase of RD$14,572.7 million more than the amount collected during the same period last year. With respect to the estimate, the compliance rate achieved was 123.7%. On the other hand, it points out that in the quarter under review, sales taxed with the ITBIS showed a growth of 9.9% and 5.2% for the total operations. As for the composition of the taxes collected by the DGII during the period January-April, 2014, 49% belongs to the Excise Tax (Consumer Tax) presenting a compliance rate of 98.5% when compared with the estimated amount, while the Direct Taxes (Annuities and Inheritances) represent the remaining 51%, bringing the level of compliance to 114.3%. |

Related News

-

(Versión en español) MINC realiza el evento "Enamórate del Arte y la Cultura" en Los Alcarrizos

-

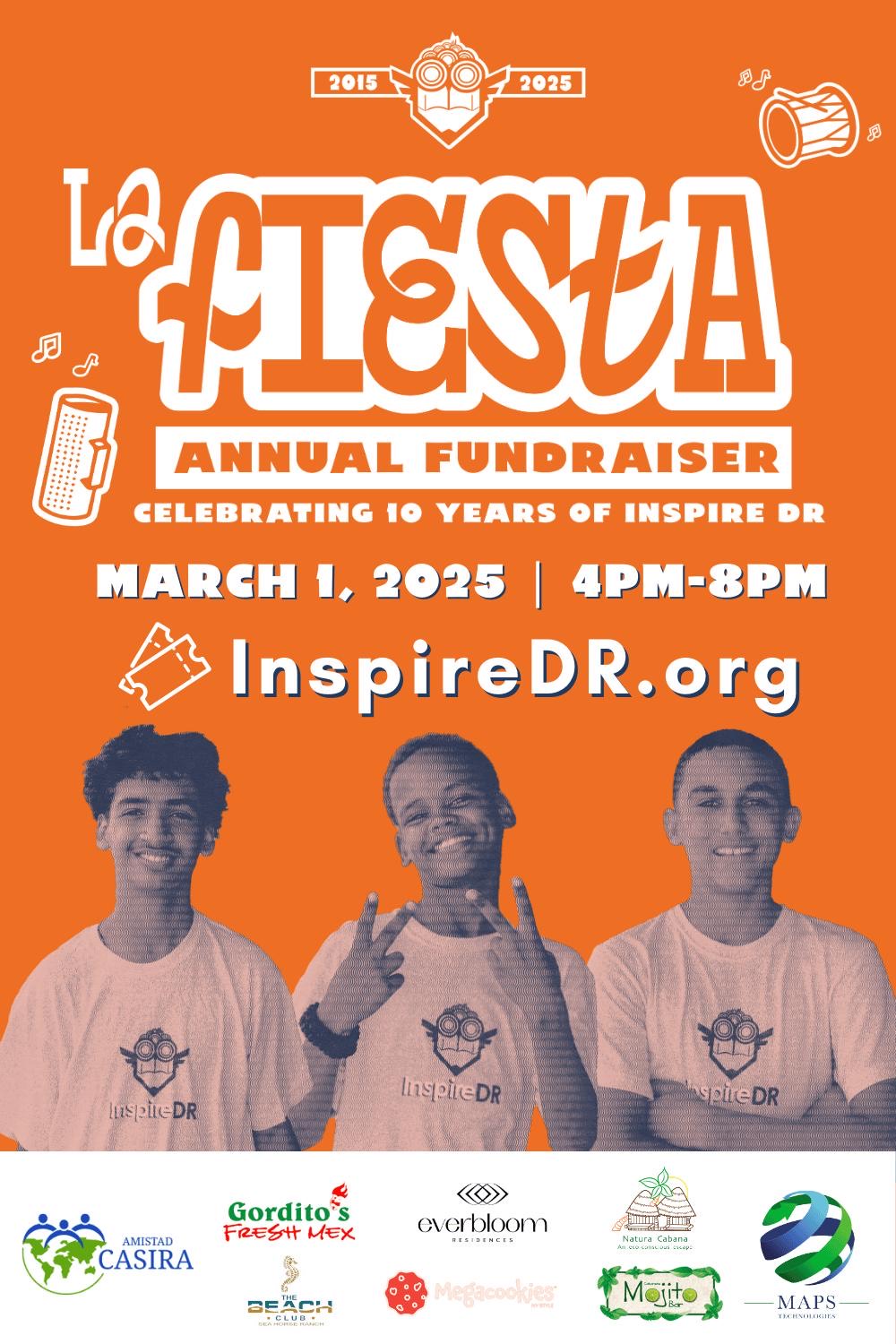

(Versión en español) InspireDR celebra una década de impacto con “La Fiesta 10” en Cabarete

-

(Versión en español) Organización “Juventud Hablemos” de la Universidad de Columbia y la GFDD copatrocinan a casa llena evento sobre “La evolución de la democracia en la República Dominicana”

-

(Versión en español) Realizan premiere del documental “El Padrino II: 50 años y su filmación en República Dominicana”

-

Actividad #1

Dónde:: Complejo Acuático Del Centro Olímpico Juan Pablo Duarte.

Días: 28 y 29 de noviembre 2016.

Precios: RD$1,1000.00 VIP, RD$600.00 gradas.