Internal revenue issues new standarsto ease infraestructure of tax solutions

| Internal revenue issues new standarsto ease infraestructure of tax solutions The General Director of Internal Revenue (Dirección General de Impuestos Internos) met with the press to explain the new phase of the tax solutions project, noted as a normal act for the tax administration. The General Director of Internal Revenues/Dirección General de Impuestos Internos (DGII) announced today a series of new norms for tax payers with commercial activities to ease the required process of implementing tax solutions. The measures are included in the General Standard 04-2014, which defines the System of Fiscal Solutions meant to facilitate the fulfillment of the tax obligation by the taxpayers, and will be implemented this Wednesday, June 4th. The Director General of Internal Revenue, Guarocuya Félix, went over the details of the new Tax Solution measures during a meeting with the press at the DGII headquarters. These new measures have a specific agreement with each taxpayer over the necessary deadlines implemented for the purpose of these Tax Solutions, the formats of billing with fiscal value, and even a tax credit for expenses related to investments on equipment or software. The General Standard 04-2014 establishes in Article 3 that every taxpayer, legal or natural, whose economic activity includes the transferring of goods or services to the last consumer involved, is required to use Tax Solutions starting on the date of its implementation. Exempt from these requirements are people benefiting from the ‘Procedimiento Simplificado de Tributación’ (PST)/Simplified Tax Procedure programs. The Director General of Internal Revenue explained that the Tax Solutions enter a new phase of implementation, this time at a national level, with the active participation of areas of compliance with the institution’s formal obligations and local administrations that operate within the country. “It’s normal for the Tax Administration” said Felix, to explain that the DGII has not stopped the installation of Tax Solutions. By the end of this year there will have been around 995 solutions to 358 taxpayers. In 2013 there were 1,274 to 341 taxpayers respectively and in 2012 there were 1,034 to 117 taxpayers. In total, starting from the year 2009, there have been 5,820 tax solutions to only 915 taxpayers, mostly from Santo Domingo and Santiago. The DGII has planned to implement 1,000 more tax solutions by the end of the year, and around 2,000 throughout 2015 all over the nation. He highlighted the success of the Tax Solutions giving the conduct of the ITBIS as an example, a tax that increased by 30% among the taxpayers who needed solutions and had them implemented, while among the ones who should have solutions yet have none implemented only grew by 17%. The General Standard 04-2014 regulates the obligations derived from the provision of the Tax Code relative to the use of proper fiscal support documents; obligations that constitute formal actions that must be fulfilled by the taxpayers and their dependents. Those businesses that are notified by the technicians of a violation in relative use of the Tax Solutions should sign an Act of Compromise to give them an allotted time so as to regulate their affairs according to the particular needs of the business. The Standard establishes that the total of costs incurred in the acquisition and installation of the Tax Solution will be recognized as a payment to the account of Taxes Over Rent to pay by the taxpayer, applying a 50% in the fiscal period that will be acquired by the corresponding Solution and the release of 50% the next fiscal period. Those who implemented in the year 2013 will have the right to access a fiscal credit 100% over the total cost of said investment.

SOLUCIONES FISCALES INSTALADAS POR AÑO  CONTRIBUYENTES CON SOLUCIONES INSTALADAS POR AÑO  INSTALACIONES POR ADMINISTRACION  |

Related News

-

(Versión en español) MINC realiza el evento "Enamórate del Arte y la Cultura" en Los Alcarrizos

-

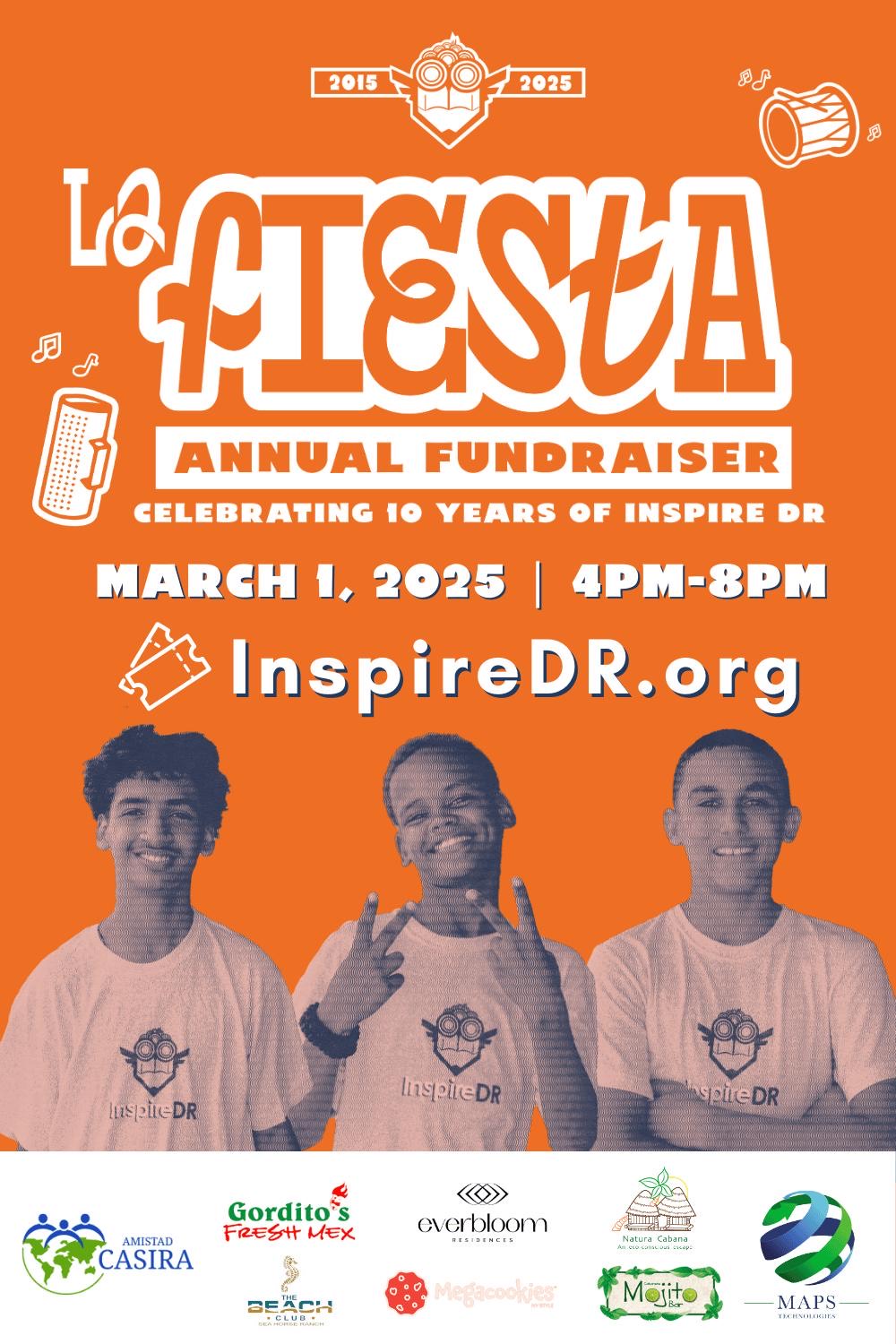

(Versión en español) InspireDR celebra una década de impacto con “La Fiesta 10” en Cabarete

-

(Versión en español) Organización “Juventud Hablemos” de la Universidad de Columbia y la GFDD copatrocinan a casa llena evento sobre “La evolución de la democracia en la República Dominicana”

-

(Versión en español) Realizan premiere del documental “El Padrino II: 50 años y su filmación en República Dominicana”

-

Actividad #1

Dónde:: Complejo Acuático Del Centro Olímpico Juan Pablo Duarte.

Días: 28 y 29 de noviembre 2016.

Precios: RD$1,1000.00 VIP, RD$600.00 gradas.