ISR Raises Exemptible Salary to RD $26,334.75 Per Month

| ISR Raises Exemptible Salary to RD $26,334.75 Per Month The General Office of Internal Taxes (DGII, Spanish acronym) announced the new income tax scales that will go into effect this year. Those who earn less than RD$26,334.75 per month will be exempt from paying income tax. That is to say, RD$2,147.84 more than last year’s (2007) exempted salary.As such, the General Office of Internal Taxes announced that the Inflation Adjustment Increase for the for the fiscal year ending December 31, 2007 will be 1.0888, as established by Article 327 of the Dominican Income Tax Code and Article 105 of Regulation No. 139-98 of the Income Tax Law. This increase has been established based on information provided by the Central Bank of the Dominican Republic. Tax Brackets and Annual Rates in effect as of January 1, 2008 are the following: Annual Income Brackets Tax Rate Income up to RD$316,017.00 Exempt Income from RD$316,017.01 to RD$474,024.00 15% of income in excess of RD$316,017.01 Income from RD$474,024.01 to RD$658,367.00 RD$23,701.00 plus 20% of income in excess of RD$474,024.01 Income from RD$658,367.01 and higher RD$60,570.00 plus 25% of income in excess of RD$658,367.01 Adjustment of Tax Brackets and Annual Rates is the result of the annual inflation measurement, calculated based on inflation rates determined by the Central Bank of the Dominican Republic. | |

| Date of Publication: January 16, 2008 |

Related News

-

(Versión en español) MINC realiza el evento "Enamórate del Arte y la Cultura" en Los Alcarrizos

-

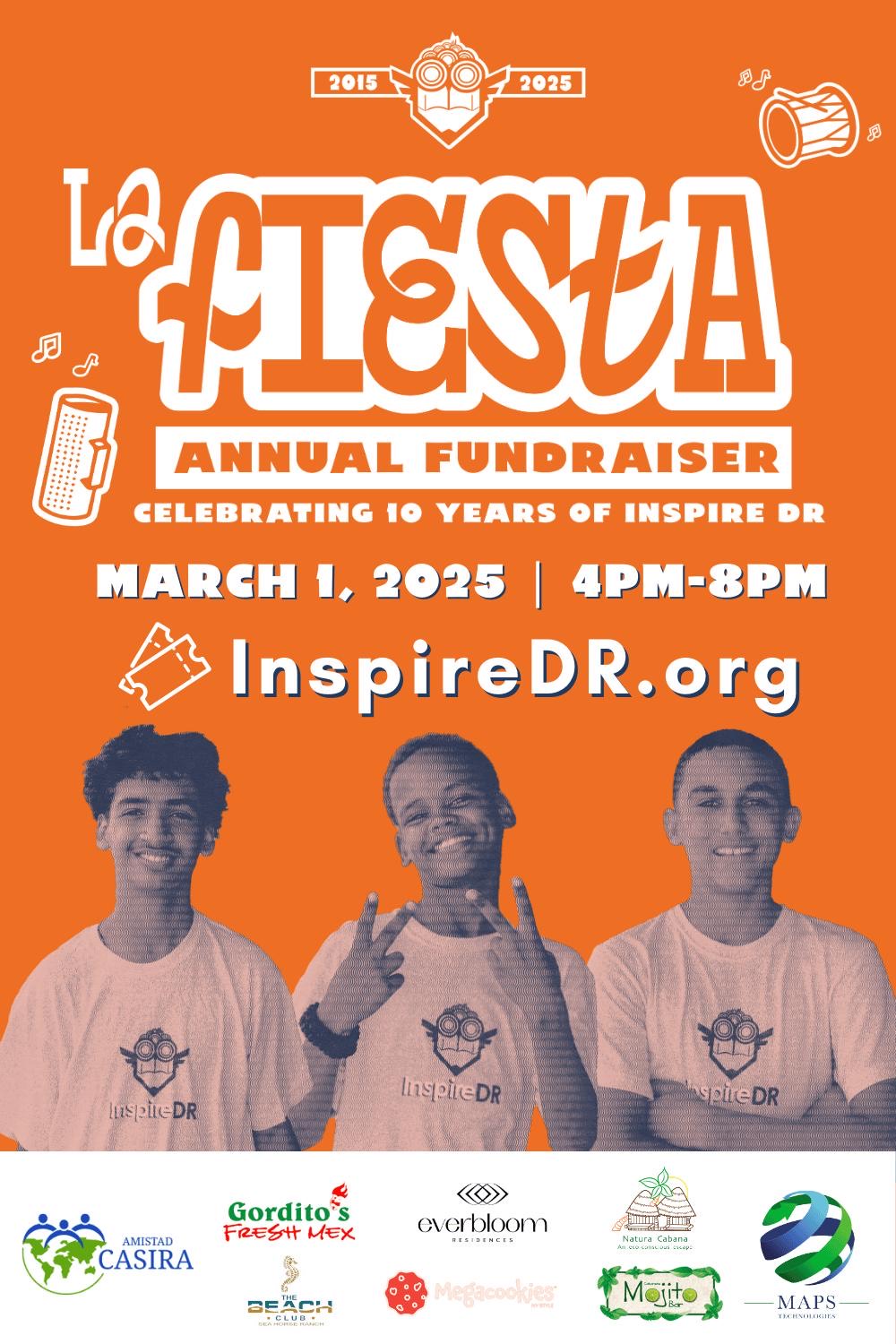

(Versión en español) InspireDR celebra una década de impacto con “La Fiesta 10” en Cabarete

-

(Versión en español) Organización “Juventud Hablemos” de la Universidad de Columbia y la GFDD copatrocinan a casa llena evento sobre “La evolución de la democracia en la República Dominicana”

-

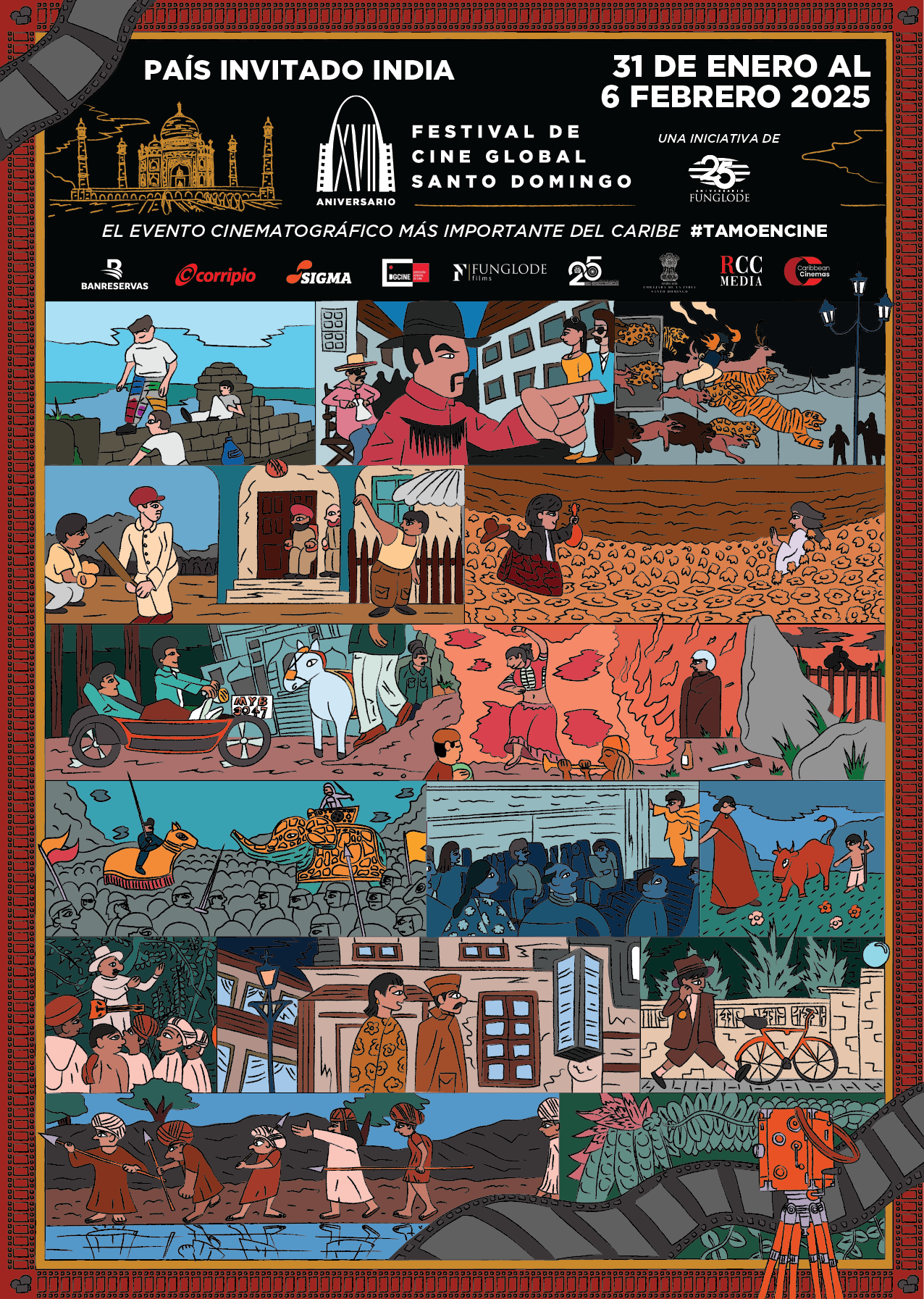

(Versión en español) Realizan premiere del documental “El Padrino II: 50 años y su filmación en República Dominicana”

-

Actividad #1

Dónde:: Complejo Acuático Del Centro Olímpico Juan Pablo Duarte.

Días: 28 y 29 de noviembre 2016.

Precios: RD$1,1000.00 VIP, RD$600.00 gradas.

© DominicanaOnline, El portal de la República Dominicana - All Rights Reserved